Case Results

$1.37

Billion

Sexual Assault Global settlements in nationally recognized sexual assault cases

$5.5

Million

Civil Litigation Wrongful conviction award

$3.3

Million

Personal Injury Sexual assault settlement

$2.75

Million

Personal Injury Confidential injury awarded settlement

$1

Million

Motor Vehicle Accident Involving police car

$320

Thousand

Motor Vehicle Accident Hit and run

$210

Thousand

Personal Injury Gun shot due to negligence

$140

Thousand

Civil Litigation Civil action recovery: unspecified personal injury

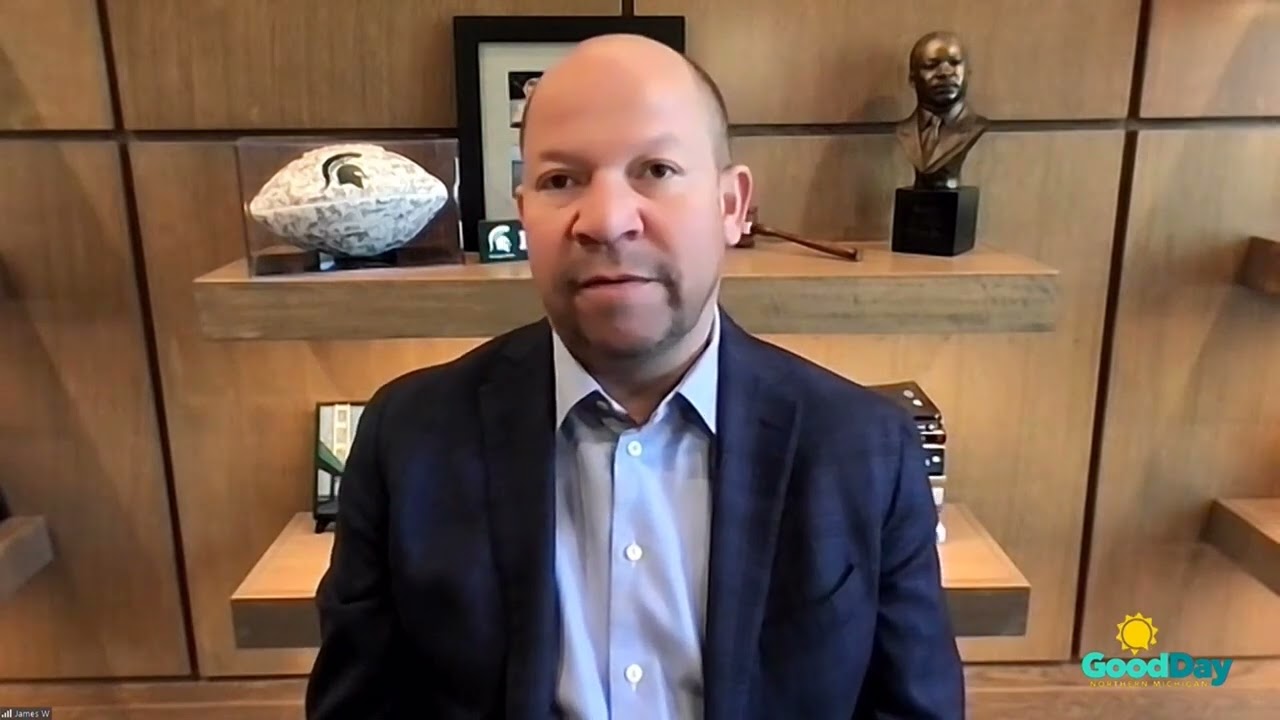

“We don't just win cases. We win justice for our clients.”

James White | Founding Attorney

Start Your Free Case Consultation With No Obligation

National & Local

Media Coverage

White Law PLLC’s exceptional legal services have been recognized in both national and local media coverage, highlighting our firm’s unwavering commitment to providing top-notch legal representation to our clients.

From major news outlets to community publications, we have garnered significant recognition in national and local media coverage, solidifying our position as a highly respected and influential law firm.

IN THE NEWS

Full-Service Law Firm

in Okemos & Surrounding Areas

Over 30,000 Clients

Helped Nationwide

We put our clients first and you will always work directly with your attorney throughout your case. Your lawyer will act as your guide, getting to know you in order to find a solution that best fits your unique needs. With our proven experience, insightful counsel, and strong work ethic, you can rest easier in the knowledge that your case is in trusted hands.

Why Choose

White Law PLLC?

We’re Experienced

We have a long track record of results across a wide range of practice areas.

We Care About Our Clients

We handle complex legal matters with skill and diligence, providing every client with the personalized services they need to minimize the potentially serious impacts of a legal issue.

We Push to Exceed Client Expectations

We strive to exceed our clients’ expectations in any case we take on.

Practice Areas

We are experienced Lawyers who can

help you with your case

Clergy Sexual Abuse

Sexual abuse is a traumatic experience that can have long-lasting consequences...

Civil Litigation

Civil litigation includes all non-criminal legal proceedings. At White Law PLLC, our...

Driver License Restoration

One of the more debilitating penalties that can come with a criminal conviction is...

Weapons Charge Defense

In Michigan, it is illegal for people to possess, use, purchase, or sell certain types of...

$1.4 Billion +

In Results

At White Law PLLC, we use a team approach to solve our clients’ legal issues, an approach that combines decades of shared insight with the use of advanced technology in the office and the courtroom.

From personal injury matters to federal criminal defense, our law firm is prepared to handle any legal challenge to clients in Okemos, Lansing and East Lansing, Detroit and across Michigan. We even handle cases nationally. Our lead attorney has been invited to the National Trial Lawyers: Top 100 Lawyers.

The

White Law

Difference

We know how to get our clients the results they need in the toughest legal arenas. As we use secure cloud-based software, it’s also easier than ever for clients to keep in touch with us and ask us questions on the go.

Our innovative management system further streamlines our process and reduces the amount of natural resources we consume. We offer the cutting-edge services and solutions you deserve.

“We know how to get our clients the results they need in the toughest legal arenas.”

James WhiteNATIONALLY

Recognized Representation

White Law PLLC was founded to provide more personalized representation to clients facing legal dilemmas. We are featured in national and local news, working hard every day to fight for our clients.

National & Local

Print Media

White Law PLLC has been featured in various national and local print media outlets, solidifying our reputation as one of the most recognized and respected law firms in the industry.

With a consistent presence in national and local print media, White Law PLLC’s exceptional legal expertise and achievements have been widely acknowledged, making us a go-to firm for clients seeking outstanding legal representation.

Articles

What Our

Clients Have To Say

Our clients speak for us, and their testimonials reflect the exceptional legal services and personalized attention that White Law PLLC is dedicated to providing.

Call for a Free Consultation

(517) 316-1195

If you or someone that you love needs legal assistance or have questions about your case, our attorneys are standing by to offer a free case evaluation.

We understand that you may be going through a difficult situation and we are ready to help however we can. Our attorneys will help tailor a custom legal strategy to your specific situation in order to achieve the best possible outcome. We will be there for you and your family every step of the way and keep you fully informed on the status of your case.

Whether your case involves a serious personal injury, sexual abuse or a criminal defense matter in Michigan, contact the team at White Law PLLC today for a free consultation of your case by clicking here or calling us at 517-618-9278