-

What Happens After You Report Sexual Abuse?

-

Are Punitive Damages Awarded in Sexual Abuse Cases?

-

What is a Victim Impact Statement?

-

What is the Bystander Effect in Abuse Cases?

-

Can Bystanders Be Held Liable in Sexual Abuse Cases?

-

What to Consider When Choosing a Sexual Abuse Lawyer

-

How Much does it Cost to Hire a Sexual Abuse Lawyer?

-

Can a Sexual Abuse Lawyer Help if the Abuse Took Place Years Ago?

-

How to Report Clergy Abuse at the Diocese of Saginaw

-

How to Report Clergy Abuse at the Diocese of Gaylord

-

How to Report Clergy Abuse at the Diocese of Marquette

-

Jehovah’s Witness Sexual Abuse Claims: What are My Rights?

-

Rabbi Sexual Abuse Claims: What are My Rights?

-

Mormon Church Sexual Abuse Claims: What are My Rights?

-

Scientology Sexual Abuse Claims: What are My Rights?

-

Pentecostal Church Sexual Abuse Claims: What are My Rights?

-

What are Legal Options for Survivors of Child Sex Abuse?

-

Can a Clergy Abuse Lawyer Help if My Abuse Happened Years Ago?

-

What Is the Christian Reformed Church’s History of Abuse?

-

How Much does It Cost to Hire a Clergy Abuse Lawyer?

-

What Are the Sexual Abuse Claims Against Grace Christian Reformed Church?

-

What is the Average Settlement for Child Sex Abuse?

-

How to Report Clergy Abuse at the Diocese of Grand Rapids

-

What Happens After You Report Clergy Abuse?

-

What to Consider When Choosing a Clergy Abuse Lawyer

-

What Type of Lawyer Deals With Sexual Abuse Cases?

-

Should I Report Sexual Abuse to My Church?

-

How to Report Clergy Abuse at the Diocese of Kalamazoo

-

How to Report Clergy Abuse at the Diocese of Lansing

-

How to Report Clergy Abuse at the Diocese of Detroit

-

Why Trauma-Informed Representation Matters in Sexual Abuse Cases

-

What is the Michigan Priest Scandal?

-

What is the Average Settlement for Clergy Abuse?

-

When to Hire a Wrongful Death Lawyer

-

What Is the Average Settlement in a Wrongful Death Case?

-

Who Can Be Sued for Wrongful Death in Michigan?

-

Why Most Sexual Abuse Is Unreported

-

Who Can Sue for Wrongful Death in Michigan?

-

Are Wrongful Death Settlements Taxable in Michigan?

-

Sexual Abuse Allegations at the Diocese of Marquette

-

Sexual Abuse Allegations at the Diocese of Saginaw

-

What Are Warning Signs of Educator Sexual Misconduct?

-

Can a School Be Held Responsible for a Sexual Assault?

-

Are Strip Searches and Pat Downs Legal in Schools?

-

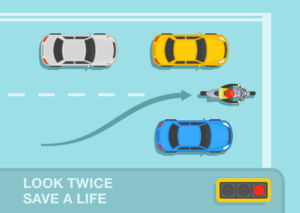

What to Do After a Motorcycle Accident

-

Should I Hire a Motorcycle Accident Lawyer?

-

Will Car Insurance Cover Motorcycle Accident Injuries?

-

When to See a Doctor After a Motorcycle Accident

-

Settlement Amounts in Sexual Abuse Cases

-

How Long Will I Be in Pain After a Motorcycle Crash?

-

What to Do if You Suspect Sexual Abuse

-

Why Is Clergy Abuse so Prevalent?

-

What Happens to Priests Accused of Sexual Misconduct?

-

Statute of Limitations for Therapist Sexual Abuse Cases in Michigan

-

What Is Clergy Abuse?

-

Financial & Emotional Compensation for Therapist Sexual Abuse

-

What to Do if My Child Was Sexually Abused by a Teacher

-

What to Expect During a Sexual Abuse Lawsuit

-

What Happens if You Refuse a Strip Search?

-

The Impact of Sexual Assault on Male Survivors

-

Are Strip Searches Legal in Jail?

-

Legal Protections for Survivors of Therapist Sexual Abuse

-

YMCA Sexual Abuse Claims

-

Boys & Girls Club of America Sexual Abuse Claims

-

What to Do if My Child Was Sexually Abused at Summer Camp?

-

Common Signs of Therapist Abuse

-

Proving Therapist Sexual Abuse: What You Need to Know

-

Long-Term Effects of Therapist Sexual Abuse on Survivors

-

How to Report Therapist Abuse in Michigan

-

Sexual Abuse in Michigan Daycares

-

Sexual Abuse in Seventh-Day Adventist Churches

-

Sexual Abuse in LDS Churches

-

Sexual Abuse in Lutheran Churches

-

Sexual Abuse in Evangelical Churches

-

How Clergy Abuse Cases Work

-

Common Signs of Clergy Abuse

-

What Is DARVO & How Is It Used Against Abuse Victims?

-

Sexual Abuse at Summer Camps

-

Sexual Abuse Allegations at the Diocese of Lansing

-

Sexual Abuse Allegations at the Diocese of Grand Rapids

-

Sexual Abuse Allegations at the Diocese of Kalamazoo

-

Sexual Abuse in Baptist Churches

-

Sexual Abuse in United Methodist Churches

-

Sexual Abuse Allegations at the Diocese of Detroit

-

Are Clergy Mandated Reporters in Michigan?

-

Sexual Abuse Allegations at the Diocese of Gaylord

-

Can Whiplash Affect Your Breathing?

-

Signs of a Bruised Lung or Pulmonary Contusion After a Crash

-

Delivery Truck Accident Statistics

-

Can You Sue for Road Rash from a Motorcycle Wreck?

-

Signs of a Broken Rib After a Car Accident

-

What Does a Personal Injury Lawyer Do?

-

Commercial Truck Accident Statistics

-

Degrees of Road Rash from Motorcycle Accidents

-

Common Types of Truck Accidents

-

Can a Car Accident Cause Breathing Problems?

-

Can a Car Accident Cause Hearing Problems?

-

Can a Car Accident Cause Vision Problems?

-

What Is the Cause of Stomach Pain After an Auto Accident?

-

Damages Available in Truck Accident Cases

-

Trucking Company Regulations in Michigan

-

How to File a Personal Injury Claim in Michigan

-

Michigan Comparative Negligence Law Explained

-

Will My Truck Accident Case Go to Trial?

-

Can You Sue Someone Personally for a Truck Accident?

-

When to Hire a Truck Accident Lawyer

-

What to Do if a DHL Truck Hits You?

-

What Is the Average Compensation for an 18-Wheeler Accident?

-

Michigan Truck Accident Statistics

-

Can You File a Personal Injury Lawsuit without a Lawyer?

-

Symptoms of Internal Bleeding After a Car Accident

-

Is It Worth Hiring a Truck Accident Lawyer?

-

Most Common Truck Accident Injuries

-

Injured from Being Run off the Road by a Truck? Legal Options

-

Steps to Take After an Accident with an 18-Wheeler

-

What to Do if a Penske Truck Hits You?

-

Can You Sue Someone Personally for a Motorcycle Crash?

-

How Long Will My Motorcycle Accident Case Take To Settle?

-

How Much Do Car Accident Lawyers Charge in Michigan?

-

How Much Do Truck Accident Lawyers Charge in Michigan?

-

When Should You Hire a Personal Injury Lawyer?

-

Legal Options for a Motorcycle Accident with Partial Fault

-

Common Motorcycle Accident Injuries

-

How to Prove that a Driver Was Texting When They Hit You

-

Accessing Traffic Camera Footage for an Injury Lawsuit

-

Accessing Cell Phone Records in Auto Accident Cases

-

Do You Have to Pay a Personal Injury Attorney Up Front?

-

Evidence Needed in Distracted Driving Accident Cases

-

Common Injuries from Head-On Auto Accidents

-

How Liability Is Determined in Head-On Auto Accidents

-

Damages Available in Michigan Personal Injury Cases

-

Top Factors that Affect Personal Injury Settlement Values

-

How Liability Is Determined in Rear-End Collisions

-

Bodily Injuries Caused by Rear-End Collisions

-

What Is the Average Compensation for a Rear-End Accident?

-

What’s the Difference Between a Retainer vs. Contingency Fee?

-

How Long Do Civil Lawsuits Take in Michigan?

-

At What Stage Do Most Civil Cases Settle?

-

How Long Does a Personal Injury Lawsuit Take in Michigan?

-

Can You Sue a Ski Resort for an Accident?

-

Should I Accept the First Settlement Offer from Insurance?

-

Ski Lift Accidents & Injuries

-

What Happens if the Other Driver Doesn’t Admit Fault?

-

What if the At-Fault Driver’s Insurance Won’t Pay?

-

Can You Sue Someone for a Ski Accident?

-

How Fault Is Determined in Ski and Snowboard Accidents

-

Preponderance of the Evidence: Standard of Proof in Civil Cases

-

How Fault Is Determined in Multi-Car Accidents in Michigan

-

What Is a Civil Litigation Lawyer & What Do They Do?

-

Can You File a Civil Suit without a Lawyer?

-

How Long Do You Have to File a Civil Lawsuit in Michigan?

-

Can You Get Punitive Damages in Michigan?

-

Do You Need a Lawyer for a Civil Suit?

-

How to File a Civil Lawsuit in Michigan

-

Is It Worth It to Pursue an Uninsured Motorist Claim?

-

What to Do if the At-Fault Driver Does Not Contact Insurance

-

Can You Sue Someone Personally for a Car Accident?

-

Can You Sue Uber If Your Driver Is in an Accident?

-

Hit by an Uninsured Motorist? How to Get Paid for Injuries

-

Are Parents Liable for Teen Driver Accidents in Michigan?

-

Can You Sue a Minor for a Car Accident in Michigan?

-

Delivery Truck Accident Liability – Who to Hold Responsible

-

What to Do If a U-Haul Truck Hits You

-

What to Do If a UPS Truck Hits You

-

What to Do If an Amazon Truck Hits You

-

What to Do If a FedEx Truck Hits You

-

Can You Sue Lyft If Your Driver Is in an Accident?

-

Suing a Rideshare Company — What You Need to Know

-

Civil Litigation Process: a Complete Step-by-Step Guide

-

Construction Zone Truck Accident – What to Do If You’re Injured

-

Rideshare Accident Statistics You Should Know

-

How Fault Is Determined in Motorcycle Accidents

-

What Are My Rights as a Passenger in an Accident?

-

Is Lane-Splitting Legal in Michigan?

-

Do I Have to Use My Own Auto Insurance If I Wasn’t at Fault?

-

Are You Always At-Fault If You Rear-End Another Car?

-

Do I Need a Lawyer for a Car Accident that Wasn’t My Fault?

-

How to Get a Police Report for a Car Accident in Detroit, MI

-

Sexual Abuse in the Amish Community

-

Sexual Abuse in Mennonite Churches

-

How to Get a Police Report for a Car Accident in Lansing, MI

-

Hit and Run Accidents – How Are They Investigated?

-

Can a Pedestrian Ever Be Considered at Fault for an Accident?

-

Southern Baptist Convention Sexual Abuse Investigations

-

Sexual Abuse Support Groups & Resources in Grand Rapids, MI

-

What to Do if a Drunk Driver Hits You

-

I Was Hit by a Car as a Pedestrian. What Are My Rights?

-

Sexual Abuse Support Groups & Resources in Detroit, MI

-

Filing a Sex Abuse Claim Against the Protestant Church

-

Legal Options for Survivors of Sexual Abuse in Michigan

-

Michigan Dram Shop Law

-

What If I Was Partially At-Fault for a Car Accident?

-

Michigan Social Host Liability Law

-

How Liability Is Determined in Pedestrian Accidents

-

The Scale of Child Sex Abuse at Religious Institutions

-

Damages that Can Be Collected in Sex Abuse Cases

-

Are Personal Injury Settlements Taxable in Michigan?

-

Sexual Abuse Support Groups & Resources in Lansing, MI

-

Filing a Child Sex Abuse Lawsuit in Michigan

-

Evidence in Sex Abuse Lawsuits

-

Are Car Accident Settlements Taxable in Michigan?

-

Filing a Sex Abuse Claim Against the Mennonite Church

-

Sexual Abuse in Protestant Churches

-

Can I Sue a Negligent Driver for More than Their Policy Limit?

-

How to Get a Police Report for a Car Accident in Grand Rapids, MI

-

Suffering From Back Pain After a Motorcycle Accident

-

Personal Injury Damages You Can Receive in Michigan

-

Experiencing Chest Pain After a Motorcycle Accident

-

Michigan Statute of Limitations for Motorcycle Accident Cases

-

What If I Have Leg Swelling After a Motorcycle Accident?

-

Most Dangerous Roads and Interstates in Lansing, MI

-

What if Progressive Denied My Accident Claim?

-

How Long Does it Take to Settle a Car Accident Claim?

-

Common Signs of Whiplash After a Car Accident

-

What to Do if Geico Denied My Accident Claim?

-

Who Pays for Medical Bills While a Lawsuit Is Pending?

-

What if Allstate Denied My Accident Claim?

-

What to Expect at a Car Accident Mediation

-

What Happens if State Farm Denied My Accident Claim?

-

What if the At-Fault Driver in an Accident Is Uninsured?

-

Auto Accident Injuries With Delayed-Onset Symptoms

-

What Happens if Nationwide Denied My Accident Claim?

-

Is Michigan a No-Fault State?

-

What to Do if Liberty Mutual Denied My Accident Claim?

-

What if Farmers Insurance Denied My Accident Claim?

-

Determining Liability in Right Turn Accidents

-

Grand Rapids’ Most Dangerous Interstates & Roadways

-

Common Brain Injury Symptoms From a Car Crash

-

How a Rollover Accident Impacts Your Body

-

Who Is At Fault in a Left Turn Accident?

-

What Are the Stages of a Personal Injury Claim?

-

The Most Dangerous Highways & Interstates in Michigan

-

What to Expect at a Car Accident Deposition

-

Who Is At-Fault in a Rear-End Collision?

-

What to Do After a Car Accident

-

Who Can Serve as a Witness in an Auto Accident Case?

-

Guide to Head Injury Types and Symptoms

-

Statute of Limitations for Personal Injury Cases in Michigan

-

How Do Colleges Handle Sexual Assault?

-

Should I Hire a Personal Injury Lawyer?

-

How Long Will it Take to Settle My Truck Accident Claim?

-

Effects Of College Sexual Assault On Survivors

-

Commercial Truck Accidents: Is The Driver Or Company Liable?

-

How to Support a Survivor of Sexual Assault

-

Can You Sue UPS for a Truck Accident?

-

How Long Does a Sexual Assault Investigation Take?

-

Statute of Limitations for Truck Accident Cases in Michigan

-

How to File a Claim Against a Trucking Company

-

Can You Sue Amazon for a Truck Accident?

-

Which Trucking Companies Have the Most Accidents?

-

What to Do After a Truck Accident

-

What Is the Red Zone on College Campuses?

-

How Confidential Is It to Report a Sexual Assault at College?

-

How to Report Sexual Assault on College Campuses

-

When to Hire a Car Accident Lawyer

-

What Is the Sexual Assault Investigation Process?

-

How do Colleges Investigate Sexual Assault?

-

Can You Sue FedEx for a Truck Accident?

-

What Is the Burden of Proof in a Criminal Defense Lawsuit?

-

What Do Cops See When They Run Your License Plates?

-

Why Is the Burden of Proof Higher in Criminal Cases?

-

Brain Bleed From Car Accident – Causes & Symptoms

-

Michigan Marijuana Laws

-

When Two Lanes Merge, Who Has the Right Of Way?

-

Can You Sue for A Concussion?

-

Recovery Time For Neck Pain After a Car Accident

-

Who Has the Right of Way When Entering the Freeway?

-

Neck Injuries From a Car Accident – a Complete Guide

-

What Is a Black Box in a Car?

-

How Long Does a Car’s Black Box Store Data?

-

Does a No-Fault Accident Go on Your Record?

-

Is Michigan a No-Fault State?

-

What Does Chest Pain After an Accident Mean?

-

Are E-Scooters Street Legal in Michigan?

-

What Is Considered a Commercial Vehicle?

-

What Foods Can Cause a False Positive in a Breathalyzer Test?

-

Felonies in Michigan – Classes & Penalties

-

Are Medical Records Disclosed in Sex Abuse Lawsuits?

-

Can You File a Sex Abuse Claim Against the Catholic Church Anonymously?

-

Michigan Drug Crime Penalties

-

Building a Defense in an Insurance Fraud Case

-

What Happens During an Arraignment?

-

How to Appeal a Criminal Conviction in Michigan

-

Can I Change My Defense Lawyer During a Criminal Trial?

-

Can Charges Be Dropped During an Arraignment?

-

Happens if You Hit a Pedestrian Jaywalking?

-

Will the Defendant Have Access to My Personal Information in a Sex Abuse Lawsuit?

-

No Contest Vs. Guilty Plea

-

Proving Innocence in a Domestic Violence Case

-

Damages That Can Be Collected in a Clergy Abuse Case

-

Will My Identity Be Kept Private in a Sex Abuse Lawsuit?

-

Can a DUI Case Be Dismissed?

-

Do You Have to Testify in a Sex Abuse Lawsuit?

-

How Prevalent Is Clergy Abuse in Different Religions?

-

Long-Term Effects of Clergy Abuse on Survivors

-

Evidence in Clergy Abuse Lawsuits

-

Do You Have to Go to Trial for a Church Sex Abuse Case?

-

History of Religious Institutions Covering Up Cases of Sex Abuse

-

Resource List for Survivors of Clergy Sexual Abuse

-

Legal Options for Survivors of Clergy Abuse

-

States With Sex Abuse Lookback Windows

-

How Long Does It Take to Settle a Clergy Abuse Case?

-

How to Report Clergy Sex Abuse in Michigan

-

Can You Sue a Church for Sex Abuse?

-

Can I File a Sex Abuse Lawsuit Against the Mormon Church Anonymously?

-

Steps to Protect Privacy in a Sex Abuse Lawsuit

-

Michigan List of Priests Accused of Sexual Abuse

-

Is Sliding on Ice Considered an At-Fault Car Accident?

-

Michigan Snow Removal Laws

-

What to Do When Driving in a Snow Squall

-

What to Do if a Snow Plow Hits Your Car

-

What is Title IX?

-

Statute of Limitations for Wrongful Death Lawsuits in Michigan

-

How to Get a Car Accident Police Report in Michigan

-

Is There a Statute of Limitations on Clergy Abuse?

-

Can a Priest Be Forced to Testify?

-

Clergy-Penitent Privilege Definition & Exceptions

-

How To Prove Wrongful Death in Michigan

-

Michigan Gun Laws

-

Penalty for Carrying a Concealed Weapon in Michigan

-

Can Police Search My Car Without a Warrant in Michigan?

-

How Long After a Car Accident Can You Sue in Michigan?

-

Medical Marijuana Laws in Michigan

-

What Was in the Water at Camp Lejeune?

-

VA Compensation for Camp Lejeune Water Contamination

-

List of Diseases Caused by Camp Lejeune Water Contamination